Though Obesity carries along with it a huge armamentarium of co-morbidities / associated problems it was always labelled as a cosmetic problem. Many decades before the only treatment which was available for obesity was liposuction, which in turn was labelled as a cosmetic procedure and hence no insurance coverage.

Liposuction however proved that it was not the solution for weight loss in the morbidly obese patients, though it gave wonderful results when used as a cosmetic procedure for the body contouring in patients with localized obesity in those who were normal or over weight.

With the advent of Bariatric Surgery, we achieved the perfect solution for significant and sustained weight loss in the morbidly obese. Along with the weight loss it was surprisingly found that those obese persons who had diabetes, high cholesterol, high B.P, Sleep Apnea, Urinary stress incontinence, Fatty liver disease, Arthritis, GERD etc, were relieved from these problems.

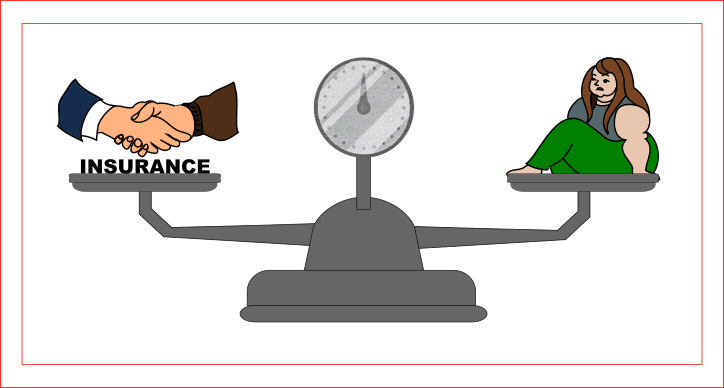

Thus Bariatric Surgery is deemed to be a blessing in disguise for the morbidly obese. Inspite of these benefits of Bariatric Surgery, insurance coverage was not available as morbid obesity still continued to be labelled as a cosmetic procedure.

Insurance for Bariatric Surgery: For many years, taking into consideration the aesthetic point of view only, the Insurance companies in India had categorised Bariatric Surgery as part of cosmetic surgery for which insurance was not applicable.

Reconsidering the multiple health risks induced by obesity and the alarming rise in obese population, the Insurance Regulatory Development Authority of India, IRDAI had shifted it from a cosmetic to a life-saving procedure and included it in the bill which became effective from 1st October 2019.

Some of the common Bariatric Surgery Procedures

Laparoscopic Sleeve Gastrectomy

Laparoscopic Roux-en-Y-Gastric Bypass

Laparoscopic Mini Gastric Bypass

This inclusion of bariatric surgery in the insurance schemes has emerged as a boon to many who are obese and struggling in life. At present most of the Insurances have included Bariatric Surgery in their surgical procedures and have extended cashless or reimbursement for the treatment.

Criteria for availing insurance:

Guidelines on Standardization of Exclusions in Health Insurance Contracts

Obesity/ Weight Control. Code- Excl06

Expenses related to the surgical treatment of obesity that does not fulfil all the below conditions:

1) Surgery to be conducted is upon the advice of the Doctor.

2) The surgery/Procedure conducted should be supported by clinical protocols.

3) The member has to be 18 years of age or older and

4) Body Mass Index (BMI);

a)greater than or equal to 40 or

b)greater than or equal to 35 in conjunction with any of the following severe comorbidities following failure of less invasive methods of weight loss:

i. Obesity-related cardiomyopathy

ii. Coronary heart disease

iii. Severe Sleep Apnea

iv. Uncontrolled Type2 Diabetes

We at TODS have been regularly performing bariatric surgeries on obese patients, now have the pleasure to announce that most of the insurance companies are now providing insurance cashless/ reimbursement for Bariatric Surgery.

TODS has tie-ups with all insurances. Contact us with your insurance details for more information at – 8880537537

Bottom line:

A stitch in time saves nine!

Get control over your weight before complications set in.